In the rapidly growing world of decentralized finance (DeFi), cross-chain bridges play a crucial role in enabling the seamless transfer of assets between different blockchain networks. These bridges provide interoperability and allow users to access a wider range of DeFi applications and services. However, with the increased adoption of cross-chain bridges, it becomes imperative to understand the security considerations involved to protect users’ funds and maintain the integrity of the DeFi ecosystem. This article explores the risks associated with DeFi cross-chain bridges and discusses various mitigations to enhance their security.

Introduction

As the popularity of decentralized finance continues to soar, the need for cross-chain bridges arises. These bridges allow users to transfer assets across different blockchain networks, expanding the possibilities and opportunities within the DeFi ecosystem. However, the security of these bridges becomes paramount due to the potential risks associated with interconnecting disparate blockchain protocols.

Understanding DeFi Cross-Chain Bridges

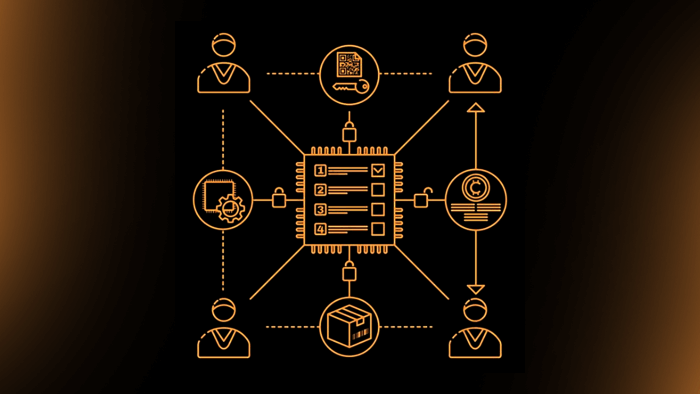

DeFi cross-chain bridges are protocols or mechanisms that facilitate the transfer of digital assets between different blockchain networks. They act as intermediaries, bridging the gap between otherwise isolated blockchains. Cross-chain bridges enable seamless asset transfers, enabling users to leverage the benefits of various DeFi platforms, regardless of the blockchain on which they are built.

Risks Associated with DeFi Cross-Chain Bridges

– Smart Contract Vulnerabilities

Smart contracts serve as the backbone of DeFi applications and cross-chain bridges. However, they can be susceptible to vulnerabilities, such as coding errors or unchecked conditions, which can be exploited by malicious actors. These vulnerabilities can lead to the loss of funds or the manipulation of asset transfers.

– Oracles and Data Feeds

Cross-chain bridges rely on oracles and data feeds to retrieve and verify information from external sources. If these oracles are compromised or manipulated, the integrity of the asset transfers can be compromised. Malicious actors may provide false information, leading to financial losses or incorrect execution of transactions.

– Interoperability Risks

Interoperability between different blockchains introduces additional complexities and potential security risks. The varying consensus mechanisms, smart contract languages, and security models across different blockchains can create challenges when establishing secure connections and maintaining data integrity during cross-chain asset transfers.

– Malicious Actors and Attacks

The decentralized nature of DeFi and cross-chain bridges presents an attractive target for malicious actors. They may exploit vulnerabilities in smart contracts, launch phishing attacks, or engage in other forms of social engineering to compromise user accounts and steal funds. Malware, ransomware, and other advanced hacking techniques can also pose significant threats.

Mitigations for Enhanced Security

To address the security challenges posed by DeFi cross-chain bridges, various mitigations can be implemented:

– Code Audits and Security Assessments

Thorough code audits and security assessments are essential to identify and rectify vulnerabilities in the smart contracts and underlying infrastructure of cross-chain bridges. Engaging professional auditors and security experts helps ensure robust security measures are in place.

– Multiple Signatures and Multisig Wallets

Implementing multiple signatures and multisig wallets can add an extra layer of security to cross-chain bridge transactions. Requiring multiple parties to authorize asset transfers reduces the risk of unauthorized access and minimizes the impact of a single point of failure.

– Trusted Oracles and Data Verification

Carefully selecting trusted oracles and implementing robust data verification mechanisms are crucial to ensuring the accuracy and integrity of information obtained from external sources. Regularly monitoring and validating oracle data helps detect and mitigate potential attacks or data manipulation.

– Cross-Chain Communication Standards

Developing and adhering to standardized cross-chain communication protocols and standards can improve interoperability and security. Establishing clear guidelines and best practices for cross-chain bridges promotes consistency and reduces the risk of implementation flaws.

– Education and User Awareness

Educating users about the risks associated with DeFi cross-chain bridges and promoting good security practices is paramount. Providing comprehensive user guides, tutorials, and security resources helps users make informed decisions and take necessary precautions to protect their assets.

Smart Contract Auditing and Bug Bounties

Performing comprehensive smart contract audits is crucial to identify and fix potential vulnerabilities in cross-chain bridges. Experienced auditors review the codebase, conduct security assessments, and provide recommendations to enhance the overall security posture. By following industry best practices and engaging with reputable auditing firms, developers can minimize the risk of smart contract vulnerabilities.

Bug bounty programs can also be implemented to incentivize the community to discover and report any security flaws. Offering rewards to individuals who identify vulnerabilities encourages a collaborative approach to security and helps identify and address issues before they can be exploited.

Cross-Chain Bridge Interoperability

Ensuring smooth interoperability between different blockchains is a significant challenge when it comes to cross-chain bridges. The varying technical specifications, consensus mechanisms, and smart contract languages across different networks can pose difficulties in establishing secure connections and maintaining data consistency during asset transfers.

To address these challenges, efforts are underway to develop cross-chain communication protocols and standards. These protocols aim to provide a common framework for cross-chain interactions, allowing different blockchains to exchange information securely and seamlessly. By adhering to these standards, developers can enhance interoperability and reduce the complexities associated with cross-chain bridges.

Overcoming Oracle Vulnerabilities

Oracles play a critical role in cross-chain bridges by retrieving and verifying external data. However, they can be a potential point of weakness if not adequately secured. To mitigate oracle vulnerabilities, several approaches can be implemented.

One such approach is the utilization of multiple oracles from different sources. By aggregating data from multiple trusted oracles, the risk of a single oracle providing false or manipulated information is significantly reduced. Implementing data verification mechanisms, such as consensus algorithms or cryptographic proofs, can further enhance the reliability of oracle data.

The Importance of User Education

Educating users about the risks associated with cross-chain bridges is paramount to fostering a secure DeFi ecosystem. Users should be made aware of the potential vulnerabilities, best security practices, and steps they can take to protect their assets.

Providing comprehensive user guides, tutorials, and security resources can empower users to make informed decisions. Emphasizing the importance of conducting independent research, verifying contract addresses, and exercising caution when interacting with unfamiliar protocols can go a long way in preventing security breaches and financial losses.

Ongoing Security Research and Development

The rapidly evolving landscape of DeFi and blockchain technology necessitates ongoing security research and development. Researchers, developers, and security experts continuously explore innovative solutions to address emerging threats and vulnerabilities in cross-chain bridges.

Collaboration between academia, industry professionals, and the open-source community plays a crucial role in advancing security practices. By actively sharing knowledge, conducting security audits, and promoting responsible disclosure of vulnerabilities, the DeFi ecosystem can stay one step ahead of potential threats.

Importance of Timely Security Updates and Patches

Regularly updating and patching the software and infrastructure supporting cross-chain bridges is essential to maintain a secure environment. Developers should stay vigilant about emerging security vulnerabilities and promptly address any identified weaknesses. By keeping up with the latest updates and security patches, the risk of exploitation is minimized, ensuring the integrity and safety of the cross-chain bridge ecosystem.

Multi-factor Authentication (MFA) and Secure Access Control

Implementing multi-factor authentication (MFA) adds an extra layer of security to user accounts accessing cross-chain bridges. By requiring users to provide multiple forms of authentication, such as passwords, biometrics, or hardware tokens, the risk of unauthorized access is significantly reduced. Additionally, enforcing secure access control mechanisms, such as role-based access controls (RBAC), helps ensure that only authorized individuals can perform critical actions within the cross-chain bridge infrastructure.

Emergency Response and Incident Management

Having a well-defined emergency response and incident management plan is crucial to swiftly and effectively address security incidents. Cross-chain bridge operators should establish protocols for detecting, containing, and mitigating security breaches. This includes procedures for incident reporting, coordination with security teams, and communication with affected users. By having a robust incident response plan in place, potential damages can be minimized, and the recovery process can be expedited.

Insurance and Risk Mitigation Strategies

Insurance coverage for potential security breaches and asset losses can provide an added layer of protection for users of cross-chain bridges. DeFi platforms and cross-chain bridge operators can explore insurance options that safeguard user funds and compensate for potential financial losses resulting from security incidents. Additionally, implementing risk mitigation strategies, such as setting limits on asset transfers or employing decentralized risk management mechanisms, can help protect user funds and prevent catastrophic losses.

Regulatory Compliance and Legal Considerations

As the DeFi landscape continues to evolve, regulatory frameworks are also being established to govern the operations of cross-chain bridges and related platforms. Developers and operators must stay informed about the regulatory landscape and ensure compliance with applicable laws and regulations. Engaging legal experts to navigate the complex legal considerations surrounding cross-chain bridges can help mitigate legal risks and ensure adherence to regulatory requirements.

Remember, staying proactive in addressing security considerations is essential to maintain the trust and confidence of users in the DeFi ecosystem. By implementing robust security measures, adhering to best practices, and actively engaging with the community, the potential risks associated with DeFi cross-chain bridges can be effectively mitigated, enabling a safer and more secure decentralized financial ecosystem.

Conclusion

DeFi cross-chain bridges are powerful tools that unlock new possibilities in decentralized finance. However, it is essential to recognize and address the security considerations to safeguard user funds and maintain the trust of the community. By implementing robust security measures, conducting regular audits, and promoting user awareness, we can strengthen the overall security posture of DeFi cross-chain bridges and foster a safer and more inclusive DeFi ecosystem.

I’m a highly experienced and well-respected author in the field of cryptocurrency. I have been involved in the industry for over 5 years and have written extensively on the topic, both for academic and general audiences. I’m highly sought-after as a speaker and consultant on cryptocurrency, due to my in-depth knowledge and understanding of the industry. I’m also a regular contributor to leading industry publications.