Bitcoin price is still a ways from its $69,000 all-time high but this isn’t stopping altcoins from moving toward new highs.

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.13 on Dec. 4, the price of Harmony (ONE) has risen 163% to establish a new all-time high of $0.38 on Jan. 14

Three reasons for the growing strength of Harmony include an expanding ecosystem, the launch of multiple cross-chain bridges and developers interest in finding Ethereum network alternatives.

ONE benefits from Harmony’s $300 million ecosystem development fund

One of the biggest boosts to the overall health of the Harmony ecosystem began back in September when the project launched a $300 million developer incentive program designed to help fund bug bounties, grants and the creation of 100 decentralized autonomous organizations (DAOs) on Harmony.

Since the launch of the program, 23 DAOs have been funded and launched on the Harmony network with more currently in development.

The incentive program has also helped attract multiple protocols to the Harmony blockchain in some of the most popular sectors of the ecosystem, including DeFi, payment platforms and nonfungible token (NFT) projects.

1/ @harmonyprotocol approves 21 more proposals for its $300M Ecosystem Fund

DeFi: @epnsproject @AnChainAI @perpprotocol @freyalacrypto

Payments: @Allbridge_io @MIM_Spell @klever_io @Trustee_Wallet

NFT: @TheDeFimons @KangaFinance @StoreyTheApp @NiftyRow

And more ⬇️ pic.twitter.com/zxyl4Z3wWJ

— Harmony (@harmonyprotocol) January 13, 2022

Cross-chain bridges help raise Harmony’s prospects

Another reason for Harmony ‘s recent strength is the launch of several cross-chain bridges that connect the Harmony network with other Ethereum Virtual Machine compatible networks like Celer and Polygon.

1/ We are excited to announce that @CelerNetwork has extended support to @harmonyprotocol.

ONE users can now use the multi-chain ‘cBridge’ to transfer $USDC and $WETH instantly and at a low-cost.

More ⬇️

— Harmony (@harmonyprotocol) January 12, 2022

On top of the most recent integration with the Celer c-bridge, which enabled the cross-chain transfer of USD Coin (USDC) and Wrapped Ether (wETH), Harmony launched a cross-chain NFT bridge as part of the Horizon bridge back in November of 2021.

Most recently, the project revealed a collaboration with the L1 protocol Cosmos to create a bridge between the two rapidly growing ecosystems in an effort to further expand its interoperability and help scale cross-chain finance.

1/ We are glad to announce that we have approved a grant for @datachain_en to build a bridge between Harmony & @cosmos.

Datachain’s experience in building interoperability solutions using trustless intermediaries is peerless.

ONE step closer towards scaling cross-chain finance pic.twitter.com/27ueWWUkT0

— Harmony (@harmonyprotocol) January 12, 2022

Harmony is also in the final stages of creating a native bridge to the Bitcoin network which is expected to be released before the end of Q1 2022.

Related: ICON commits $200M to interoperability incentive fund

New users and ecosystem growth back record high TVL

Another bullish metric backing Harmony’s growth is its rising TVL, which is now at an all-time high of $1.25 billion according to data from Defi Llama.

Several DeFi protocols are thriving on the Harmony network, including DeFi Kingdoms (JEWEL), which accounts for $747 million of the TVL, Tranquil Finance with $201.85 million and Viperswap with a $54.4 million TVL.

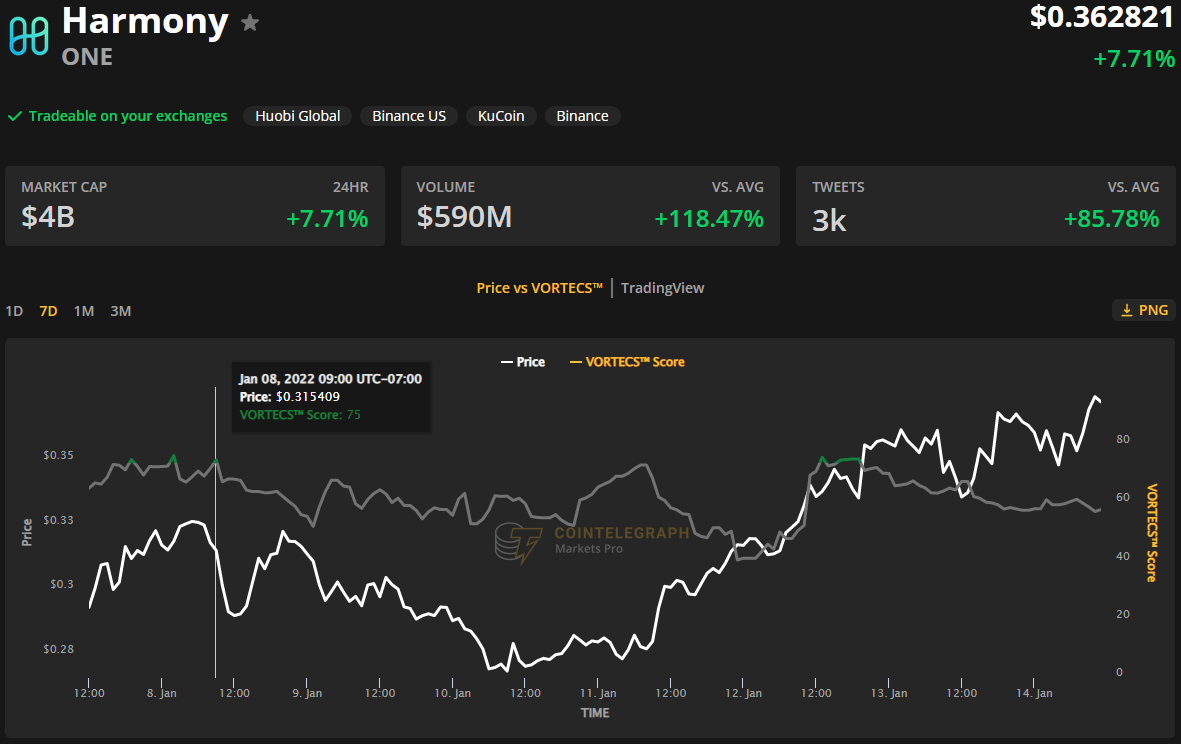

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for ONE on Jan. 8, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score for ONE spiked into the green zone on Jan. 8 and hit a high of 75 around 48 hours before the price proceeded to increase 50% over the next four days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

I’m a highly experienced and successful crypto author with over 10 years of experience in the field. I have written for some of the most popular crypto publications, including Bitcoin Magazine, CoinDesk, and Crypto Insider. I have also been featured in major mainstream media outlets such as Forbes, Wall Street Journal, and Business Insider.